You know those eye-catching envelopes you find stuffed in your mailbox? The ones that claim you’ve been “pre-qualified” or “pre-approved” for a new credit card or car loan? If you’ve been shopping for home loans, you’ve likely noticed those same terms floating around.

As if buying a home wasn’t daunting enough without needing a dictionary to define the differences between the two, some mortgage professionals use the terms interchangeably. We’re here to help eliminate as much confusion as possible. So, let’s break down pre-qualification vs. pre-approval so you can bid on that dream home with confidence.

The basics of pre-qualification vs. pre-approval.

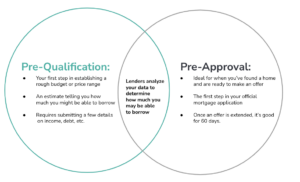

Think of pre-qualification vs. pre-approval as circles in a Venn diagram. The two terms are closely related, but represent separate steps in the home buying process.

According to the Consumer Financial Protection Bureau (CFPB), both options are statements from a lender estimating how much you might be able to borrow.

Fast Facts:

- Pre-qualification: When you submit basic information to get a rough budget for your home purchase.

- Pre-approval: When a lender completes a full review of your information (credit score, income, assets, etc.) and extends a preliminary loan offer. In a competitive housing market, a pre-approval can really give you an edge over other buyers.

Prepping for Pre-Qualification

Pre-qualification is a solid first step in your home buying process. It’s ideal for establishing a general budget and price range for homes, and typically requires answers to questions about income, employment, and debts.

Pre-Qualification Pro-Tip: Your pre-qualification isn’t an official loan offer and is only as accurate as the information you provide. Artificially inflating your income won’t help much when it’s time to apply for your loan. Estimate your mortgage amount and monthly payments with our free mortgage calculator.

Pursuing Pre-Approvals

Think of pre-qualification as a surface-level look at your information. Pre-approval, on the other hand, requires actual documentation and a deeper review by an underwriter before generating a conditional* offer that’s (usually) good for 60 days.

For a pre-approval, your lender reviews your W-2s, pay stubs, tax returns, and more to estimate a loan amount. Pre-approval is ideal if you’ve started your home search, partnered with a real estate agent, and are actively searching for a loan.

*The lender will confirm your financial documents, loan terms, and other conditions before the final approval.

Pre-Approval Pro-Tip: You may be pre-approved to borrow more money than you need or more than you’re comfortable spending on a home. Be mindful of your budget and don’t feel pressured to take the full amount. We recommend limiting your search to homes within a comfortable price range—something only you can decide.

Which One Is Right for You?

Now that you know the key differences between pre-qualification and pre-approval, it’s time to start thinking about which option best suits your needs. Ask yourself: How far along are you in the journey of homeownership? Are you just looking around, or are you ready to talk numbers? Our handy table below can point you in the right direction.

| Pre-qualification | Pre-approval | |

|---|---|---|

| Where are you in the process? | Searching around to find out how much you might be able to borrow. | You’ve found your dream house and you’re ready to make an offer. |

| What are you willing to provide? | Basic details (i.e. income and employment) | Proof of income, assets and other financial details. |

How to handle a pre-qual curveball

While you may receive pre-qualification from a lender, that doesn’t mean you’re approved to borrow that loan amount. Pre-qualifications are a general estimate of your home loan eligibility. Pre-approvals dig a lot deeper, but neither are final home loan approvals.

In some cases, lenders may provide pre-qualifications and pre-approvals for less than what you expected. Alternatively, lenders may not extend either of those options at all. If that happens, don’t panic. These decisions aren’t made lightly, but there are steps you can take to prepare for next time.

- Contact the lender to find out why you weren’t approved for a certain loan amount or why you were denied an offer outright. Was your credit score too low? Have certain accounts gone delinquent? Is your debt-to-income ratio too high? Knowledge is power, and the right lending partner will help you identify areas of improvement.

- Ask the lender for a copy of the credit score they used or take the time to request your own report. If your pre-approval was denied, lenders are required to provide a notice containing the credit score they used to make the decision and instructions on how to obtain a free copy of your credit report.

So, ready to get pre-approved for your mortgage?

That wraps up today’s lesson! Now that you know the ins-and-outs of pre-qualification vs. pre-approval, it’s time to make the next move. Are you ready to start looking at homes? Do you already have one in mind? No matter where you are in the process, our team can help.

Now that you know the key differences between pre-qualifications and pre-approvals, it’s time to start thinking about which option best suits your needs.